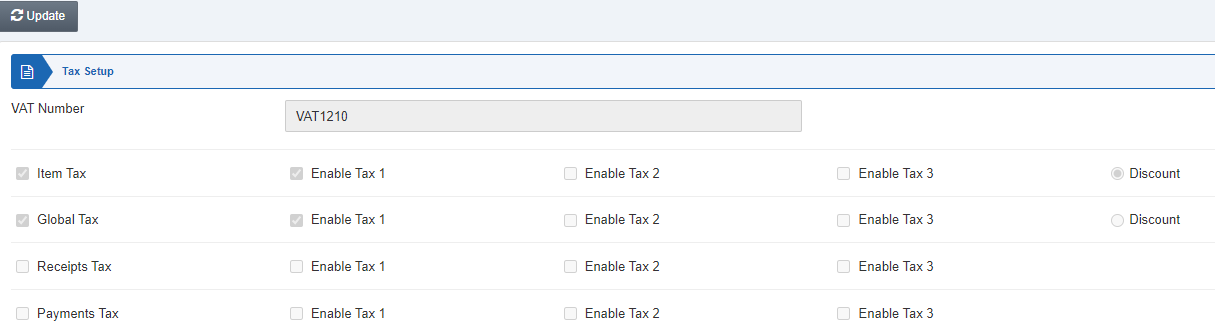

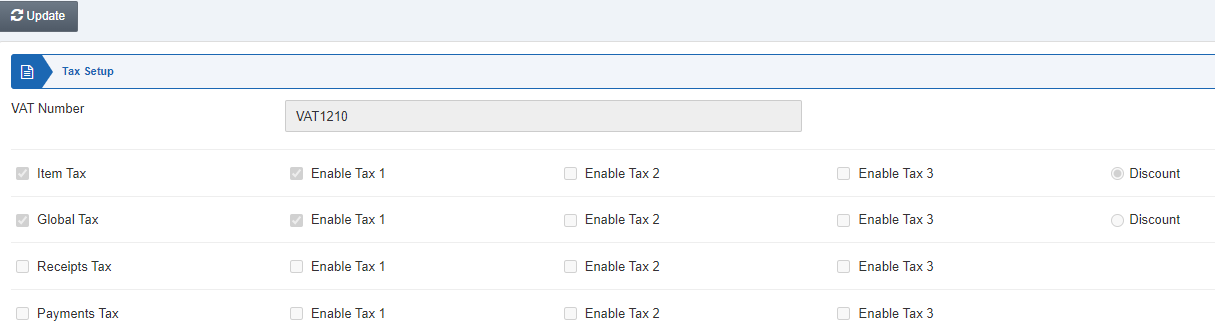

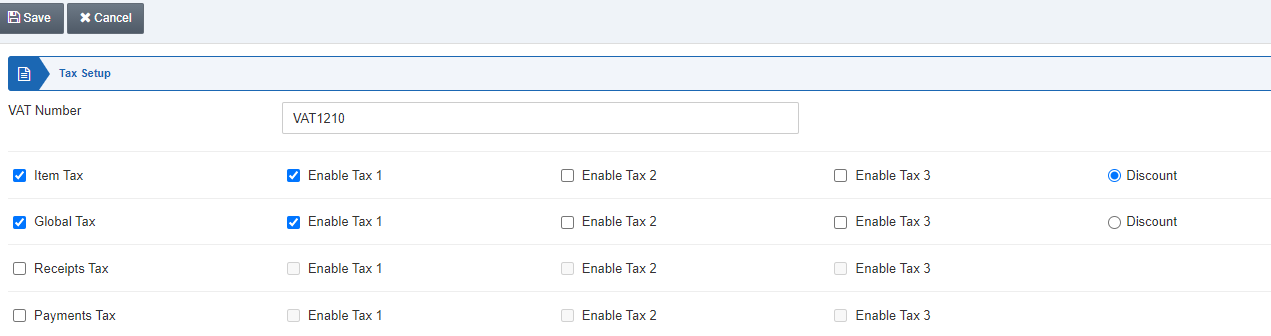

Tax Setup allows you to set the control of the four types of taxes that are item tax, global tax, receipts tax, and payments tax. You can control the taxes with each tax available up to three stages.

VAT Number: You can enter your company’s VAT number in this field. Where the VAT number is the Value Added Tax Number.

Note: The Item Tax is calculated based on each item’s price whereas the global tax is applied on all the items purchased by a customer in an invoice.

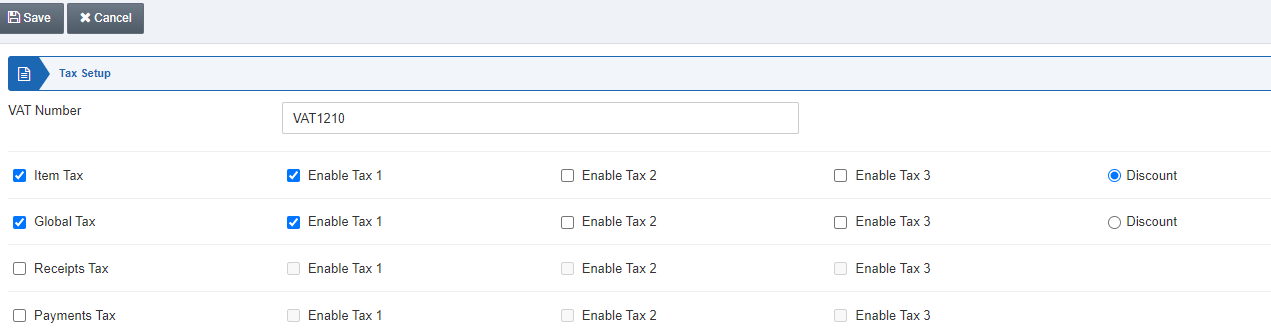

Updating/Editing Item Tax

To update or edit the item tax, go to Configurations > Tax Setup > Tax Setup, the Tax Setup page is displayed.

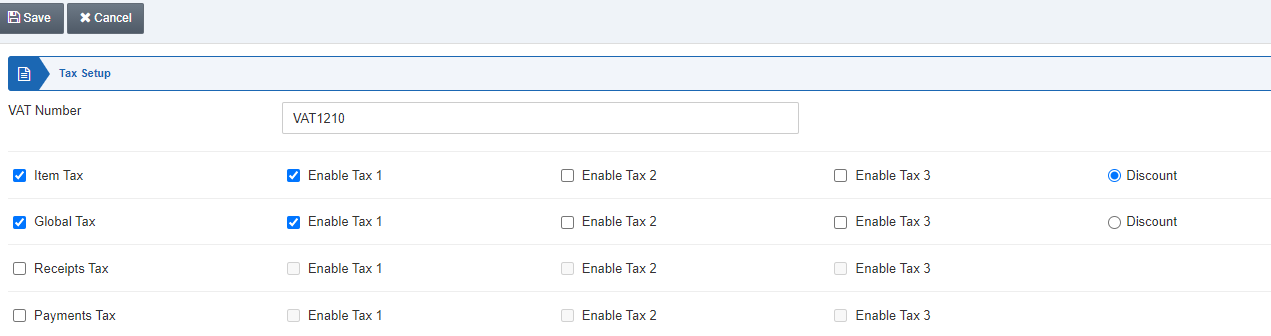

Click the Update button on the top of the tax setup page.

If you want to enable item tax then check the Item Tax checkbox and click the Save button.

You can enable the taxes by checkboxes like Enable Tax 1, Enable Tax 2, and Enable Tax 3. There are up to three taxes available. Also, the Discount can be selected or unselected as per your requirement.

Updating/Editing Global Tax

To update or edit the global tax, go to Configurations > Tax Setup > Tax Setup, the Tax Setup page is displayed.

Click the Update button on the top of the tax setup page.

If you want to enable tax on global tax then check the Global Tax checkbox and click the Save button.

Similarly, global tax is available in three stages like Enable Tax1, Enable Tax 2, and Enable Tax 3. Discounts can be selected or unselected based on the requirement of your company.

![]()

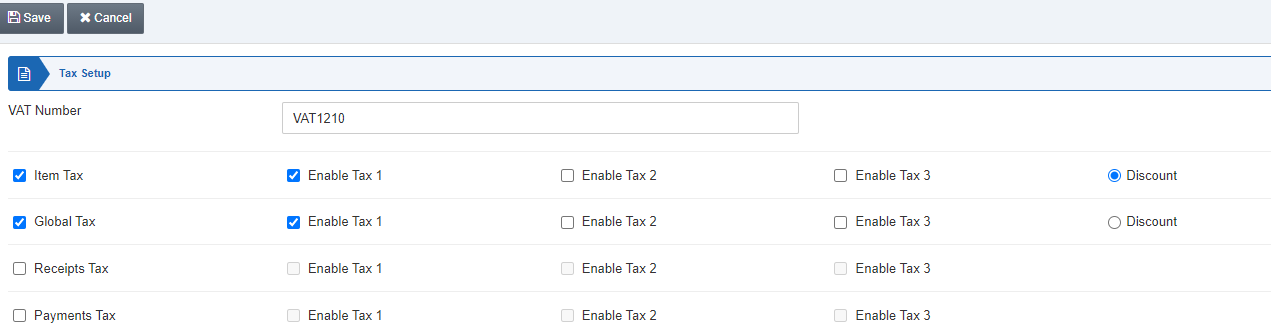

Note: The discount can be either selected for item tax or global tax at a time.

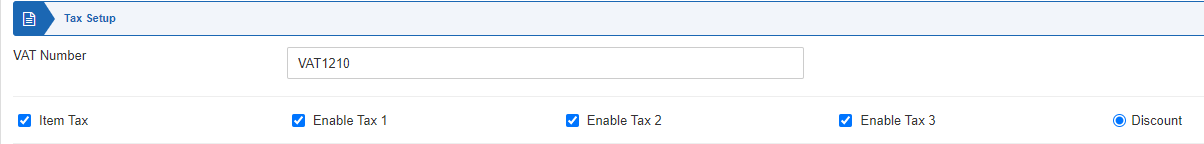

Updating/Editing Receipts Tax

To update or edit the receipts tax, go to Configurations > Tax Setup > Tax Setup, the Tax Setup page is displayed.

Click on the Update button.

![]()

Note: The Receipts Tax is meant for the Financial Accounting Module and refers to the tax calculated on payment receipts.

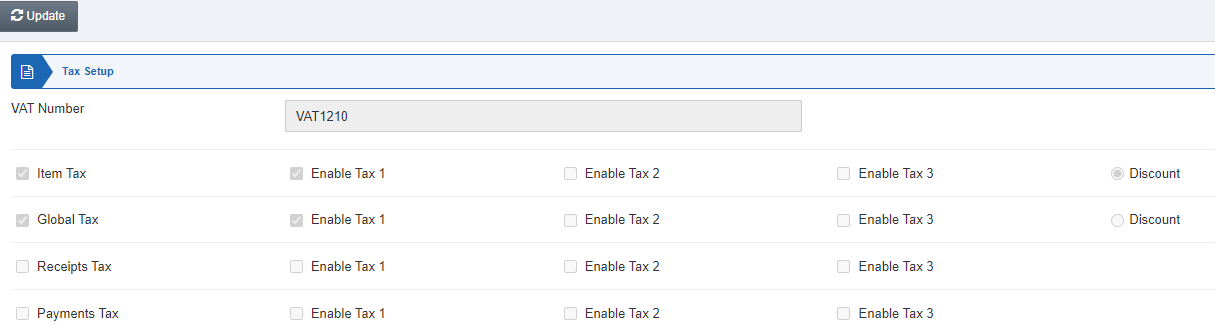

Updating/Editing Payments Tax

To update or edit the payments tax, go to Configurations > Tax Setup > Tax Setup, the Tax Setup page is displayed.

Click on the Update button.

![]()

Note: The Payments Tax is meant for the Financial Accounting Module and refers to the tax calculated on payment transactions.